Every choice you make, particularly regarding the tools you employ, is crucial while trading a prop firm account. Additionally, if you use MetaTrader 5 (MT5) then you have likely seen the MACD and Stochastic Oscillator indicators more often than you would want to acknowledge. These two tools appear in practically every trading school, YouTube video, and trading technique. Which one performs better when trading with a prop firm? That is the key question.

Now, we won’t describe it with definitions from textbooks. To assist you in deciding if MACD or Stochastic is a better option for your funded account, let’s break this out in a way that truly makes sense using reliable information.

Why This Even Matters for Prop Traders

It’s one thing to trade your own money. But when you’re handling the finances of a prop firm? That is a whole different situation. Strict drawdown restrictions, guidelines for waiting for news, and occasionally even deadlines for meeting profit goals are all in place. Therefore, employing the appropriate indication isn’t just about increasing your winning trades; it’s also about overcoming the difficulty period, controlling your emotions, and remaining consistent.

This implies that you need an indication that suits you and your trading style, not just a good one. This is when the MACD vs. Stochastic battle starts.

What the Heck Are MACD and Stochastic Anyway?

Alright, for the sake of being thorough, let’s get a quick refresher.

MACD (Moving Average Convergence Divergence)

In essence, the MACD is a momentum indicator that tracks trends. It measures how two moving averages a quicker EMA and a slower EMA relate to one another. The MT5 trading platform usually displays a histogram, a signal line, and a MACD line.

What is it used for? It assists you in determining:

- Whether momentum is growing or decreasing

- When a trend may turn around

- Possible sites of entry and departure based on crossovers

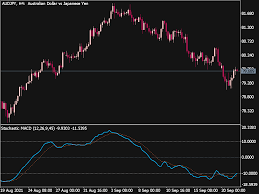

Stochastic Oscillator

In contrast, the stochastic is more of a momentum oscillator that is limited in range. It evaluates a closing price in relation to a range of prices over a specific time frame. The outcome? Values ranging from 0 to 100 indicate whether a pair is oversold or overbought.

It’s excellent for:

- Recognizing possible market reversals in sideways trends

- Identifying overbought and oversold areas

- Signals for short-term entrance

Therefore, while they both measure momentum, they do it in very different ways.

Which One Works Better on MT5?

For Scalpers: Speed Is Everything

Scalping with a prop firm is risky. One wrong move and you could hit your drawdown limit in minutes. So you need quick and accurate signals.

MACD for Scalping?

The MACD tends to lag a bit because it’s based on moving averages. In fast-moving markets, it often gives signals after the move has already started.

Stochastic for Scalping?

Much better. The Stochastic Oscillator is quicker to react and great for spotting short-term overbought or oversold conditions. That quick snap-back in price? Stochastic catches it faster.

Winner: Stochastic

If you’re scalping on MT5 with a prop account, Stochastic gives you faster and more actionable signals—especially on the 1-minute or 5-minute charts.

For Day Traders: Riding the Waves

Day trading on a prop account usually means you’re holding trades for a few hours max. You want something that gives you confirmation but doesn’t lag too far behind.

MACD for Day Trading?

Now we’re talkin’. The MACD works well on the 15-minute to 1-hour charts. It helps confirm whether a trend is real or just noise. That histogram can be super useful for seeing momentum buildup before a breakout.

Stochastic for Day Trading?

Still useful, especially if you’re ranging. But it can throw off false signals in trending markets. Ever had a trade where Stochastic screamed “overbought,” and price just kept going?

Winner: Tie (But Context Matters)

If you’re trading breakouts or trends, go MACD. If you’re range trading or fading moves, stick with Stochastic. Better yet—combine both and use one to confirm the other.

For Swing Traders: Big Picture, Big Signals

Swing traders love holding trades for days or even a week or two. In this case, lag isn’t as much of a problem because you’re not chasing micro-moves.

MACD for Swing Trading?

Perfect fit. MACD helps spot long-term trend changes and gives clean signals when the market shifts direction. Those MACD crossovers on the 4H or daily chart? They’re gold for swing entries.

Stochastic for Swing Trading?

Still usable in swing trading, but less reliable. The longer the timeframe, the more erratic Stochastic can get. You’ll get lots of false “overbought” signals in an uptrend.

Winner: MACD

If you’re trading higher timeframes on a prop account and need fewer, more reliable entries, MACD takes the cake.

Which One’s Easier to Use on MT5?

Both indicators are super user-friendly on MT5. Just drag and drop from the Navigator panel and you’re good to go.

That said:

- MACD has a cleaner look, especially with that histogram showing momentum visually.

- Stochastic has those clean lines at the 20 and 80 levels which some traders find easier to interpret at a glance.

It really comes down to preference. If you’re a visual person then you might like the MACD’s histogram. If you like precise levels then Stochastic might feel more intuitive.