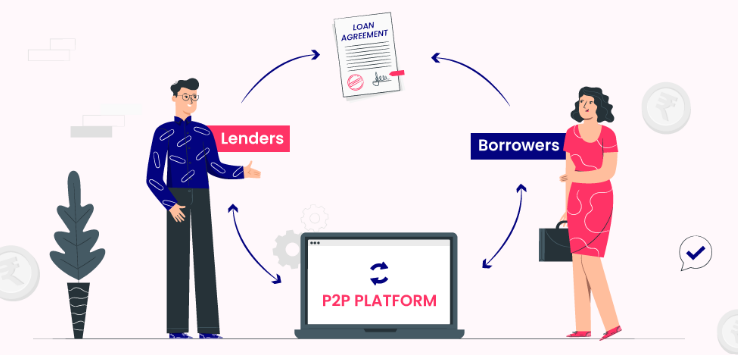

Are you tired of low returns from traditional investment avenues? Consider peer to peer lending, also known as online lending, P2P lending, crowdfunding loans, marketplace lending, social lending, or alternative lending. P2P lending is a borrower-lender marketplace that connects borrowers and lenders directly.

By eliminating traditional intermediaries such as banks, P2P lending platforms offer potential for higher returns than conventional fixed-income investments. Moreover, borrowers can access loans at lower interest rates compared to those offered by banks.

In this article, we will delve deeper into the world of peer to peer lending, explore its advantages, and guide you on choosing a reliable P2P lending platform. We will also provide tips for successful lending to help you make the most of your investment.

Understanding Peer to Peer Lending

Peer to peer lending, also known as P2P lending, is a revolutionary alternative to traditional lending. In P2P lending, borrowers and lenders connect directly through online platforms, thereby eliminating the need for intermediaries like banks.

P2P lending offers many benefits, such as lower interest rates for borrowers and higher returns for lenders. Let’s take a closer look at how it works:

How P2P Lending Works:

First, borrowers create profiles on P2P lending platforms and provide information about the amount of money they need and the purpose of the loan. Lenders then review these profiles and decide which borrowers to fund. Typically, lenders can fund a portion of a loan, spreading their investment across multiple borrowers to mitigate risk.

Once funded, borrowers receive the loan amount and begin making repayments, which are distributed to lenders as monthly payments with interest. P2P lending platforms charge a fee for providing the service, but these fees are generally lower than those charged by traditional banks.

The Advantages of P2P Lending:

There are many advantages to P2P lending, making it an attractive option for both borrowers and lenders. For borrowers, P2P lending offers lower interest rates and a simplified loan application process. For lenders, P2P lending platforms allow for diversification of investments and the potential for higher returns than traditional savings accounts or investments.

| Borrowers | Lenders |

|---|---|

| Lower interest rates than traditional banks | Higher returns than traditional savings accounts or investments |

| Simplified loan application process | Diversification of investments across multiple loans to mitigate risk |

| Access to funds without collateral | Option to fund a portion of a loan, spreading investment across multiple borrowers to mitigate risk |

Overall, P2P lending offers a modern solution to traditional lending, offering opportunities for both borrowers and lenders.

The Advantages of Peer to Peer Lending

Peer to peer lending, also known as P2P lending, marketplace lending, or alternative lending, offers several benefits for investors and borrowers alike.

Higher Interest Rates for Lenders

One of the significant advantages of P2P lending is the potential for higher returns for individual lenders compared to traditional bank deposits. Online lending platforms enable lenders to earn interest rates ranging from 4% to 10% or more annually, depending on the risk level and type of loan.

Lower Interest Rates for Borrowers

Borrowers can take advantage of P2P lending to access lower interest rates than those offered by credit cards, with rates usually falling between 5% to 20% annually, depending on creditworthiness. This can be an excellent option for those struggling with high-interest debt or who need access to funds for large purchases or emergencies.

Diversification Opportunities

P2P lending provides investors with opportunities to create a diverse portfolio of loans, spreading their investments across various loan types, risk levels, and borrower profiles. This diversification minimizes the risk of losing all investments in case of borrower default, and can provide consistent returns as different types of loans are repaid.

Simplified Loan Application Processes

Traditional bank loan application processes can be time-consuming and complicated. In contrast, P2P lending platforms often have a streamlined and user-friendly online application process, allowing borrowers quick access to financing. This ease of access and fast decision-making is especially crucial for individuals who need immediate funding to address financial emergencies.

In conclusion, the advantages of P2P lending such as higher returns for lenders, lower interest rates for borrowers, diversified investment opportunities, and simplified loan applications make it an attractive option for both borrowers and investors alike in the world of online lending, marketplace lending, and alternative lending.

How to Choose a Reliable P2P Lending Platform

Investing in a P2P lending platform can provide substantial returns if you choose the right one. However, with numerous platforms out there, selecting a reliable platform can be a daunting task. To simplify the process, consider the following:

1. Platform Reputation

Research the platform’s history and reputation. Look for reviews and ratings from reputable sources to get an idea of their track record and customer satisfaction. Ensure that the platform is transparent about its lending practices and loan security measures.

2. Borrower Qualification Criteria

Check out the platform’s borrower qualification criteria. Lenders prefer platforms that thoroughly screen borrowers, as this reduces the likelihood of loan defaults.

3. Loan Security Measures

Ensure that the platform has safety precautions in place to mitigate the risk of fraud and loan default. Some security measures might include verification of borrower’s identities, collection of collateral, and insurance coverage.

4. Fees and Charges

Be aware of the various fees and charges involved. Some P2P lending platforms charge for loan origination, servicing, and collection. Ensure that you understand the fee structure, so you’re not surprised by hidden charges later.

5. User-friendly Interface

Choose a platform that has a user-friendly interface for both lenders and borrowers. The platform should provide easy access to invest and track your portfolio. With a user-friendly interface, investors can monitor account performance, borrower’s profiles, and loan status easily.

Choosing a reliable P2P lending platform requires time and research. Keep in mind that you are investing your money, and the platform’s credibility can significantly impact your returns. It is best to evaluate multiple platforms before making a decision. Use the above criteria as a starting point to make an informed investment decision.

Tips for Successful P2P Lending

Direct lending and social lending are two types of peer to peer lending that can offer significant returns when executed strategically. Here are some tips to help ensure successful P2P lending:

- Diversify your investments: Spread your investments across a range of loans to minimize risk and increase potential returns.

- Thoroughly assess borrower profiles: Look beyond credit scores to evaluate a borrower’s financial stability and repayment history.

- Stay updated on platform policies: Familiarize yourself with the lending platform’s terms and policies to ensure compliance and avoid any surprises.

By applying these tips, you can maximize the benefits of direct and social lending in the peer to peer lending space. Remember to evaluate investments carefully and stay informed to make the most of your P2P lending strategy.

Taking the Plunge into Peer to Peer Lending

Investing in peer to peer lending has the potential to provide high returns on investment with lower risk than traditional lending channels. As with any investment opportunity, careful research and analysis are required to choose the right platform and borrower.

As we have explored in this guide, peer to peer lending is a relatively new approach to online lending that connects borrowers and lenders directly through online platforms. It eliminates intermediaries such as banks, giving investors higher returns than they would get from traditional savings accounts or bonds.

However, like any investment, it does come with risks. It is important to investigate the credibility and security measures offered by the platform before investing. Assessing the borrower’s creditworthiness is also critical to mitigate risks of defaults.

That being said, peer to peer lending presents numerous opportunities for earning solid returns. Unlike traditional investments, peer to peer lending allows investors to diversify their portfolio easily and take advantage of smaller investment opportunities.

To make the most of your investment, it is essential to stay informed about the changing policies on the platform and be prepared to adjust your investment strategy accordingly. It is also advisable to avoid investing all your money in one loan or on one platform.

In conclusion, with thorough research and careful analysis, peer to peer lending can be a smart investment opportunity for those seeking to earn solid returns. Remember to be vigilant about the platform’s credibility, thoroughly assess borrower profiles and diversify your investment portfolio to enjoy the benefits of this alternative lending option.

FAQ

What is peer to peer lending?

Peer to peer lending, also known as online lending or P2P lending, is a form of crowdfunding where individuals can lend money directly to borrowers through a borrower-lender marketplace platform. It eliminates the need for traditional banks as intermediaries.

How does peer to peer lending work?

Peer to peer lending works by connecting borrowers and lenders directly through an online platform. Borrowers create loan listings with the amount they need and the interest rate they are willing to pay. Lenders review these listings and decide how much they want to invest in each loan. Once the loan is funded, borrowers receive the funds and start repaying the loan with interest.

What are the benefits of peer to peer lending?

Peer to peer lending offers several advantages. For lenders, it provides the opportunity to earn higher interest rates compared to traditional savings accounts or other investments. For borrowers, it often offers lower interest rates than traditional banks. Additionally, peer to peer lending allows for diversification of investments and offers a simplified loan application process.

How do I choose a reliable P2P lending platform?

When selecting a peer to peer lending platform, it is important to consider factors such as the platform’s reputation, borrower qualification criteria, and loan security measures. Research the platform’s track record, read reviews, and ensure they have robust borrower screening processes in place. It is also wise to understand the platform’s loan security measures and how they protect lenders from potential defaults.

What are some tips for successful P2P lending?

To increase your chances of successful peer to peer lending, consider diversifying your investments by spreading your funds across multiple loans. Thoroughly assess borrower profiles, including their credit history and the purpose of the loan. Stay updated on the platform’s policies, including any changes in interest rates or lending criteria. Additionally, monitor your investments regularly and reinvest any repayments received to maximize returns.

What should I consider before participating in peer to peer lending?

Before participating in peer to peer lending, it’s important to conduct thorough research and familiarize yourself with the potential risks involved. Understand the platform’s fees, default rates, and procedures for handling late or missed payments. Assess your own risk tolerance and only invest what you can afford to lose. It’s also advisable to consult with a financial advisor to determine if peer to peer lending aligns with your investment goals.